Bank Nifty Investing: Can it Give Consistent Returns?

Bank Nifty is one of the most followed indices that reflects the performance of the banking sector in the stock market.

This index captures the performance of the leading banks in India. For many investors, this gives an opportunity to be a part of the banking industry, which can act as a great indicator of economic health.

But then again, one big question is: do investments in Bank Nifty provide consistent returns? This article explores whether Bank Nifty can provide consistent returns, highlighting its performance history, and factors driving returns.

Performance of Bank Nifty Over the Years

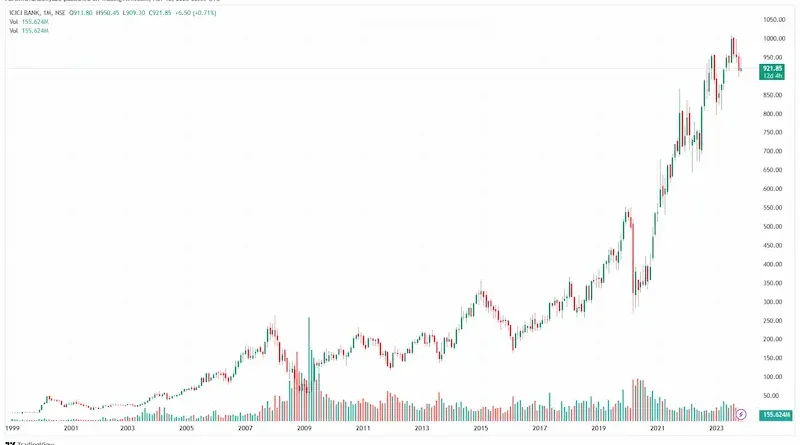

Over the years, the Bank Nifty index has demonstrated significant growth. For example, in 2007, it was valued at approximately ₹9,863.45. By 2024, it had risen to ₹51,215.25, marking an increase of over 419% during this period. This translates to a compound annual growth rate (CAGR) of about 10.1%.

Notably, in September 2024, the index reached an all-time high of ₹54,467.35. However, it’s important to recognize that the index has experienced fluctuations, including a significant drop in 2008 when it fell by 49.3% due to the global financial crisis.

Despite such volatility, the overall long-term trend has been upward.

Factors Driving Bank Nifty’s Returns

When it comes to investing in Bank Nifty, understanding what really drives its ups and downs can make all the difference. Let’s jump into the key factors that influence Bank Nifty’s returns and see what keeps this index ticking.

1. Economic Growth Cycles

The economy is closely tied to the growth of the banking sector. When the economy grows, demand for loans and financial services rises, boosting bank profits and positively impacting Bank Nifty today.

However, during economic downturns, banks face challenges like slower loan growth and higher loan defaults, which can reduce the index’s returns.

Hence, Bank Nifty’s movement often tracks the overall business cycle and thus is very sensitive to economic fluctuations.

2. Interest Rates, Inflation, and Monetary Policy Impacts

Interest rates set by the Reserve Bank of India (RBI) play a major role in bank profitability. Lower interest rates encourage borrowing, increasing loan growth, while higher rates can slow down borrowing.

Inflation affects costs and spending power, influencing banks’ ability to maintain profit margins.

RBI’s monetary policies directly impact banks’ lending and borrowing rates, affecting Bank Nifty’s performance.

3. Reforms, Tech, and Asset Quality

Government reforms, such as measures to reduce non-performing assets (NPAs) or encourage digital banking, strengthen the banking sector.

New technology adoption (like digital platforms) helps banks reach more customers and reduce costs.

Additionally, maintaining high asset quality, or reducing bad loans, is crucial for stable earnings and positive sentiment around Bank Nifty.

Risks Involved in Bank Nifty Investing

So yes, Investing in Bank Nifty can offer high returns. But it also comes with risks that you should keep in mind. Here are the main risks:

- Regulatory and Economic Changes: The banking sector is heavily influenced by government policies and economic changes. For instance, changes in interest rates or regulations can impact banks’ profits, which affects Bank Nifty’s performance.

- Non-Performing Assets (NPAs): NPAs are loans that banks give but don’t get repaid on time. High NPAs mean banks lose money, which hurts their stock prices and impact Bank Nifty.

- Global Events and Volatility: Events like international crises or market shocks can make Bank Nifty volatile, meaning its value can go up or down quickly. Banks are sensitive to these changes, which can impact investor returns.

Therefore, understanding these risks helps you be more prepared and make informed choices in Bank Nifty investing.

Conclusion

Bank Nifty can offer good returns, but its performance depends on changes in the economy and market trends, so it may not always be steady. For investors, it can still be a good choice as part of a balanced investment plan, though some ups and downs are likely. Finally, using the best online trading platform can help you track and manage your Bank Nifty investments more easily and make better-informed choices.